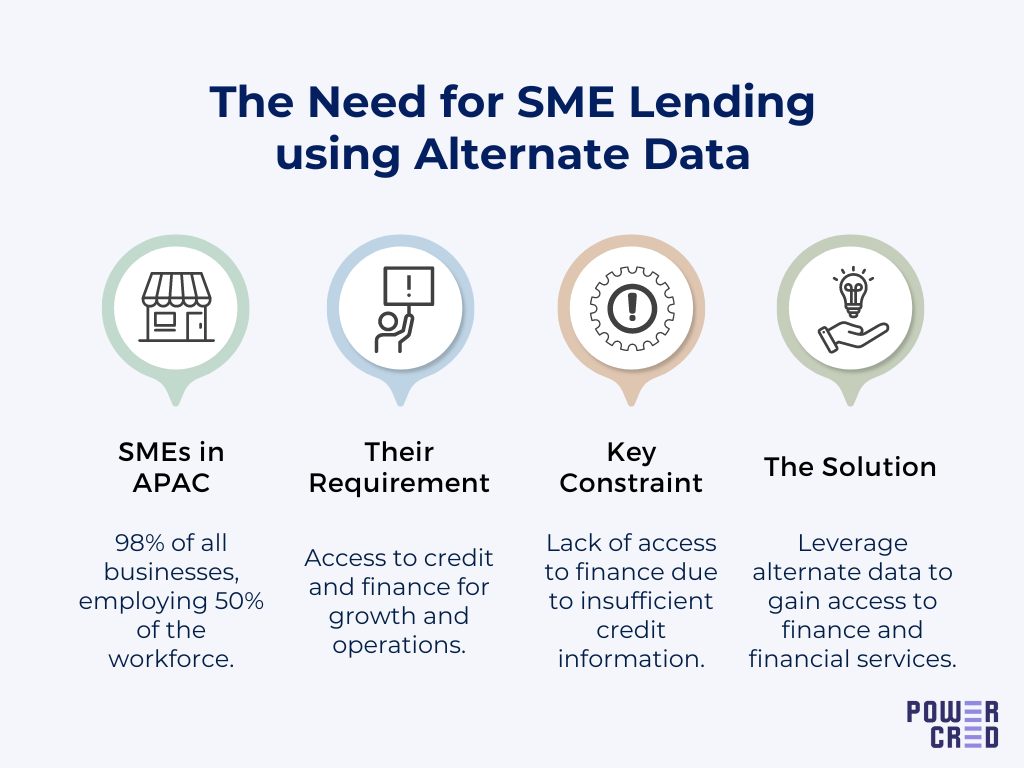

Small and medium enterprises or SMEs are integral to the growth of economies owing to their contribution to the GDP and the employment they generate, especially in developing countries. In the Asia Pacific region, SMEs represent about 98% of businesses and employ over 50% of the workforce. While most governments have been introducing policies to support the growth of the SME sector, SMEs today are still facing several constraints hampering their growth, a key constraint being access to credit and finance. SMEs in APAC face a US$2 trillion funding gap, still dealing with the effects of the COVID-19 pandemic.

SMEs often remain unbanked or underbanked due to the lack of adequate access to finance via traditional banks. Sourcing finance the traditional way is difficult for SMEs since they often lack enough credit data or supporting documents needed by the banks to assess their creditworthiness and offer them the required amount of loan. Banks consider these SMEs as ‘thin file’ applicants that are high-risk, making them either non-eligible for loans or eligible for partial or high-interest loans.

As a result, SMEs are now turning to new-age lenders and financial institutions that are leveraging alternate data of the SMEs to offer them access to finance. Alternate data provides the lenders with information from non-traditional sources that enables them to assess the creditworthiness and business health of SMEs to make better lending decisions.

How are lenders and financial institutions using alternative data?

The traditional way of lending by banks involved scrutinising the typical bank statements and other financial documents of the borrower to assess the risk and creditworthiness of the borrower. Lending using alternative data involves aggregating alternate data from several data points and analysing them in a structured manner to get insights into the creditworthiness of the borrower. Financial institutions and lenders are using alternate data independently or to augment the traditional data available to make better lending decisions while serving the unbanked or underbanked SMEs.

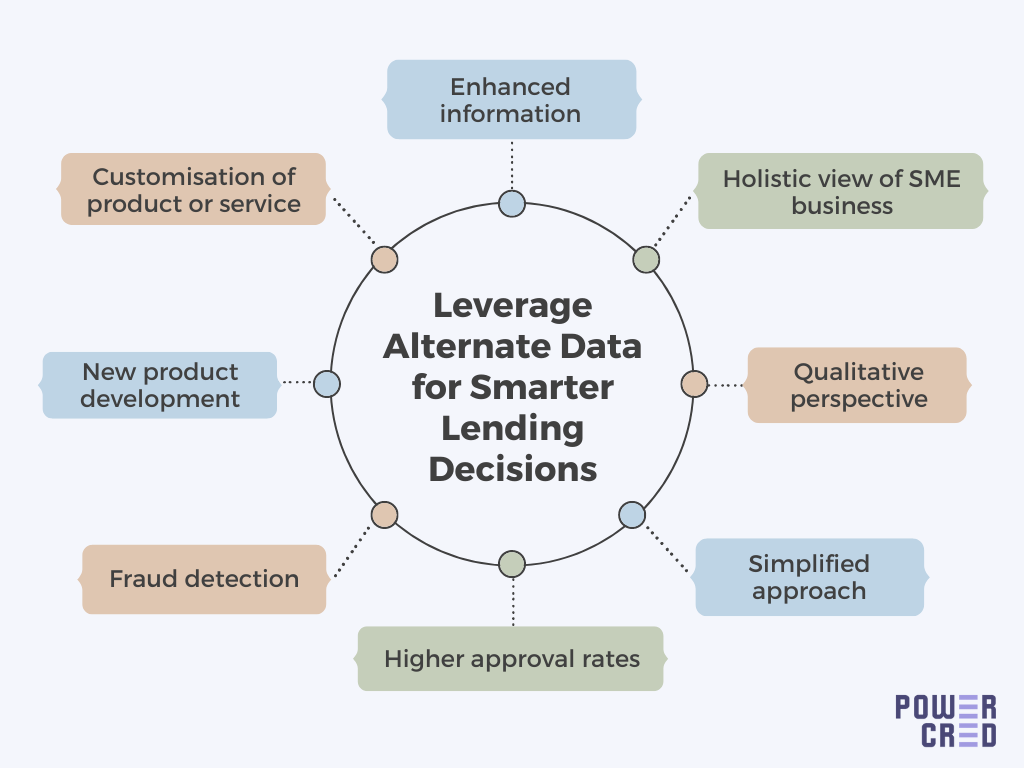

Alternate data is helping financial service providers make better lending decisions while catering to SMEs in the following ways:

Enhanced information

Alternate data APIs aggregate information from multiple data sources including but not limited to accounting systems, digital wallets, payment partners, e-commerce, social media, book-keeping tools, websites, mobile applications and geolocation data. Such data bridges the information gap and provides lenders with insights that can help offer sufficient loans to the ‘thin file’ borrower applicants.

A holistic view of business health

Alternate data goes beyond traditional data sources to give lenders a holistic view of the borrower’s business health and performance. Alternate data can help lenders gain insights into the demand forecasts, revenue forecasts, sales data, buying patterns, industry trends and market trends that can help understand the business’ health, performance and competitiveness, improving the lender’s risk assessment of the borrower.

Qualitative perspective

The scope of information from alternate data sources includes both quantitative as well as qualitative information that can add value to the decision-making process. Lenders can gain insights from non-quantitative data such as sentiment data to judge qualitative aspects of a business including its popularity on social media, customer reviews and store ratings.

Simplified approach

Alternate data is often fetched from multiple data points in a raw, unstructured format. However, with alternate data APIs, alternative data is made available from multiple data points in a structured format that is seamless access and convenient to analyse. Adding layers of intelligence to the aggregated alternative data can further help simplify and automate the risk assessment process, minimising the need for manual intervention and the chances of human error.

Higher approval rates

Lending basis insights from alternative data could result in higher approval rates as against lending the traditional way due to the availability of data to assess the underbanked or unbanked borrower’s creditworthiness. Alternate data provides real-time information from multiple sources that can help lenders assess not just the creditworthiness of an SME but also the repayment capacity, transaction patterns and risk behaviour, to drive lending decisions including customised interest rates best suited to the borrower’s requirements and repayment capacity.

Fraud detection

With growing digitalisation, online fraud has become a lot more common and sophisticated. The cost of fraud rose 10% – 16% across APAC as compared to the pre-pandemic levels in 2019. Lenders can track discrepancies in the data aggregated from multiple alternate data sources, including data generated from the digital footprint of the borrower, to identify possible fraud. Validation of data from different alternative data sources can help identify and prevent possible fraud, reducing the costs and losses associated with such fraud.

Personalisation and customisation of services

Alternate data can help lenders with real-time information to understand the current and dynamic needs of their customers, enabling them to offer customised or personalised products and services to best suit their customer’s requirements. This helps enhance the customer journey and experience with the lender and the overall lending process.

Conclusion

Alternative data is becoming increasingly important for the SME lending ecosystem due to the value it adds to the lending process and decision-making. Alternative data is not just paving way for better financial inclusion of SMEs but also improving the SME lending experience for the borrowers and optimising the process for the lenders. Financial institutions are able to minimise costs by leveraging alternate data sources for SME lending, benefits of which they are able to pass on to the borrower SMEs with lower interest rates. For SMEs in APAC, a competitive interest rate is the top loan decision driver and could be a potential reason for them to ditch traditional banks for other financial service providers. Insights from alternate data are also helping financial service providers understand their customer’s dynamic needs to build new and better products to support their growth. Thus, lending using alternative data is creating a win-win situation for both the lenders and SMEs, making credit more accessible to the underbanked and unbanked thereby promoting their growth and financial inclusion.

To know more about how we help our clients leverage the power of alternate data to make better lending decisions, get in touch or simply book a demo with our team.