Small and medium enterprises have been transforming digitally and growing at a rapid pace, contributing to slightly over 61% of Indonesia’s GDP. To support such rapid growth or to stay afloat during upcoming uncertainties, these small businesses require access to credit, preferably in a quick and hassle-free manner. Small businesses typically experience difficulties in gaining access to the required finance primarily due to the absence of adequate financial information and the high risk perceived by financial service providers in offering credit to these businesses without access to insights into their creditworthiness and repayment capacities.

With the growing awareness and availability of small business data from alternative sources, financial services providers are able to enhance their risk assessment models to narrow the credit gap for small businesses. Leveraging such small business data can help financial service providers gain insights into the business’ performance, the small business owner’s creditworthiness, repayment capacity and other aspects that can help them assess risk better. While financial service providers are looking to narrow the credit gap by enhancing their risk assessment models, let us first understand some of the key challenges being faced by them while assessing the credit risk of small business customers.

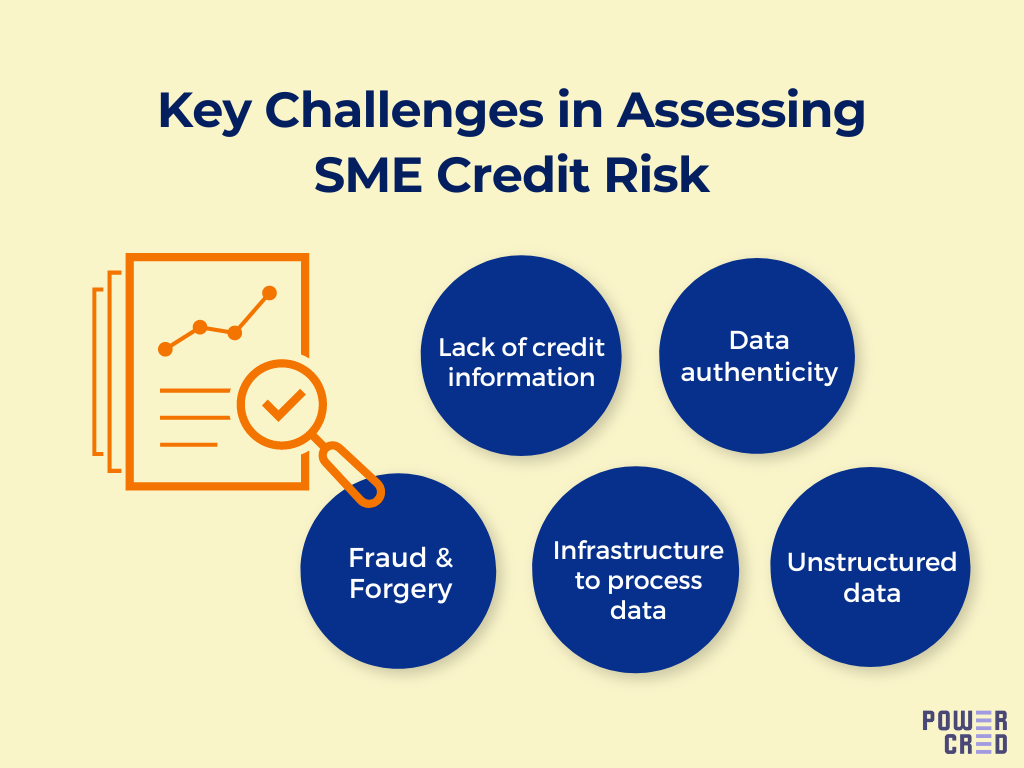

The Key Challenges in Assessing Credit Risk

Lack of substantial credit information: Financial service providers often find it difficult to assess the creditworthiness of small businesses due to a lack of adequate credit information. Applications often get rejected since financial service providers are not too keen to take the high risk involved in catering to such thin-file small businesses, without access to insights into their repayment capacity and business performance. However, it is now possible to assess some of these small businesses with their data from alternative sources. For digitally transformed SMEs, leveraging the data generated from their digital footprint can enable financial service providers to offer them access to credit.

The authenticity of data: The user-generated data provided by small businesses often lacks credibility and the authenticity of such data may be questionable. There may also be a possibility of such user-generated data being forged to avail the required amount of credit by a previously rejected applicant. Therefore, such unauthenticated data cannot be trusted to form the basis for risk assessment and informed credit decisions.

Fraud: Small businesses are going digital at an unprecedented pace. The accelerated growth of digitalisation has resulted in a consequent increase in online fraud, identity fraud being one of the most commonly committed frauds today. With online fraud becoming more sophisticated and difficult to detect, financial service providers need to be more vigilant while assessing risk and need to find new ways to detect and prevent such fraud, minimising losses associated with such fraud.

Infrastructure to process data: Financial service providers now have access to small business data from alternative sources however they may still lack the necessary infrastructure to process and analyze such data to gain actionable insights from it. Building and managing the infrastructure to leverage such data in-house for risk assessment can be highly resource-intensive and non-feasible to financial service providers, diluting their focus from their core operations.

Unstructured alternative data: The small business data being extracted from alternative data sources is made accessible to financial service providers in a raw, unstructured format. Such raw data needs to be processed and structured for analysis by financial service providers to gain actionable insights enhancing their risk assessment and decision-making. PowerCred addresses this issue and enables financial service providers to gain access to structured small business data with unified APIs for ease of analysis and smarter credit decision-making.

The current scenario

Financial service providers are digitally transforming and innovating to improve their risk assessment processes and to offer financial products that are increasingly relevant to the dynamic needs of their small business customers. Financial service providers are collaborating with fintech players to solve the challenges faced in assessing small business credit risk with APIs and data intelligence. PowerCred is also helping financial service providers gain access to authenticated and consented small business data of their customers to enhance their risk assessment models. PowerCred offers unified APIs that allow financial service providers to access consented small business data from multiple platforms and the intelligence to gain actionable insights from such data for smarter risk assessment and credit decision-making.

If you’d like to know more about how we help financial service providers enhance their risk assessment models, get in touch with our team or book a free demo.