The accelerated growth of digitalisation has resulted in a consequent increase in online fraud, identity fraud being one of the most commonly committed frauds today. Identity fraud increased by 44% in 2019 and hasn’t gone down since then. The scope of online operations for businesses is fast-growing due to the increase in the use of digital platforms and technologies by their customers and competitors, pushing businesses to transform digitally. With more businesses going digital at an unprecedented pace, there needs to be a parallel focus on fraud detection and prevention as well.

Such frauds may have been avoided previously by simple observation of discrepancies in the data collected from traditional sources of information. However, with growing digitalisation, online frauds have become a lot more sophisticated and difficult to detect especially for businesses that are new to the digitally transformed way of operations. The new-age way of detecting and preventing online fraud needs to be based on the observation of real-time information of customers that can further be analysed by data intelligence to flag possible fraudulent discrepancies.

Alternate data and fraud detection

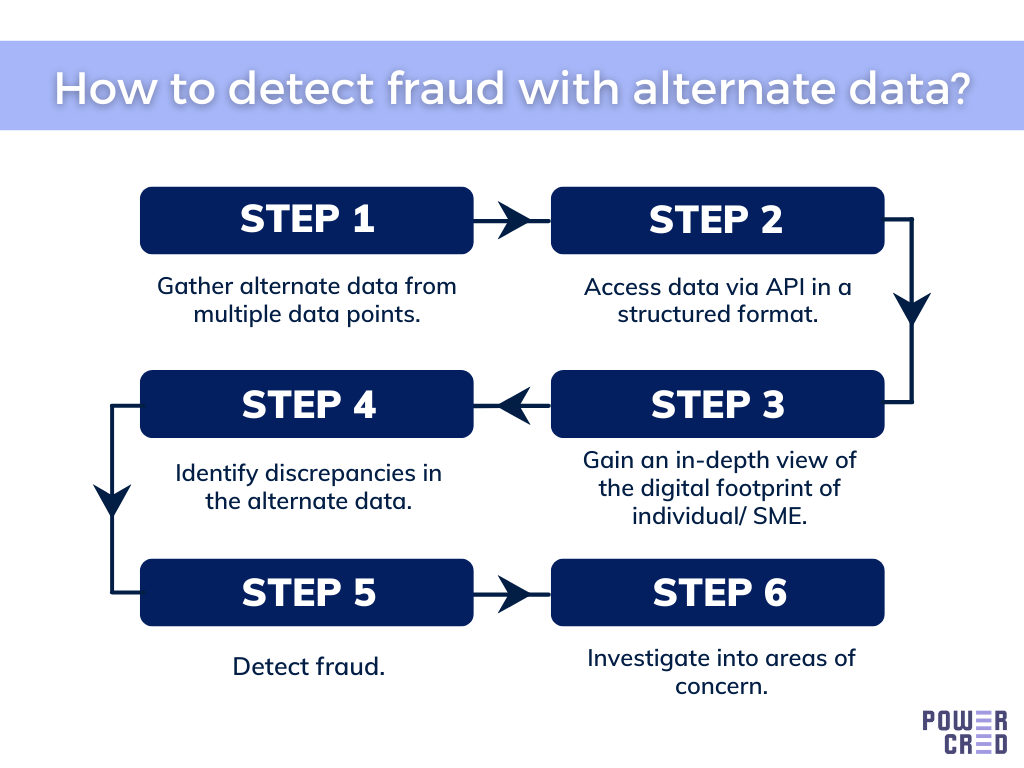

Simply put, alternate data is the data collected from non-traditional sources that can be used to supplement existing traditional data or be used independently to gain valuable insights that can help detect and prevent fraud in a digital-first environment. Alternate data provides multiple layers of information gathered from several data points, giving a more in-depth view of an individual or business’ digital behaviour, performance and overall footprint. Accessing and observing such real-time data of customers can be helpful in spotting discrepancies and in flagging off potential frauds.

To make this process quick and convenient, there are APIs that provide seamless access to alternate data from multiple data sources in a structured manner. Such structured data is easy to refer to and identify possible fraudulent discrepancies, as compared to readily available raw data. For more sophisticated frauds that may miss the human eye, alternate data intelligence can help identify and flag potential frauds that can be further investigated.

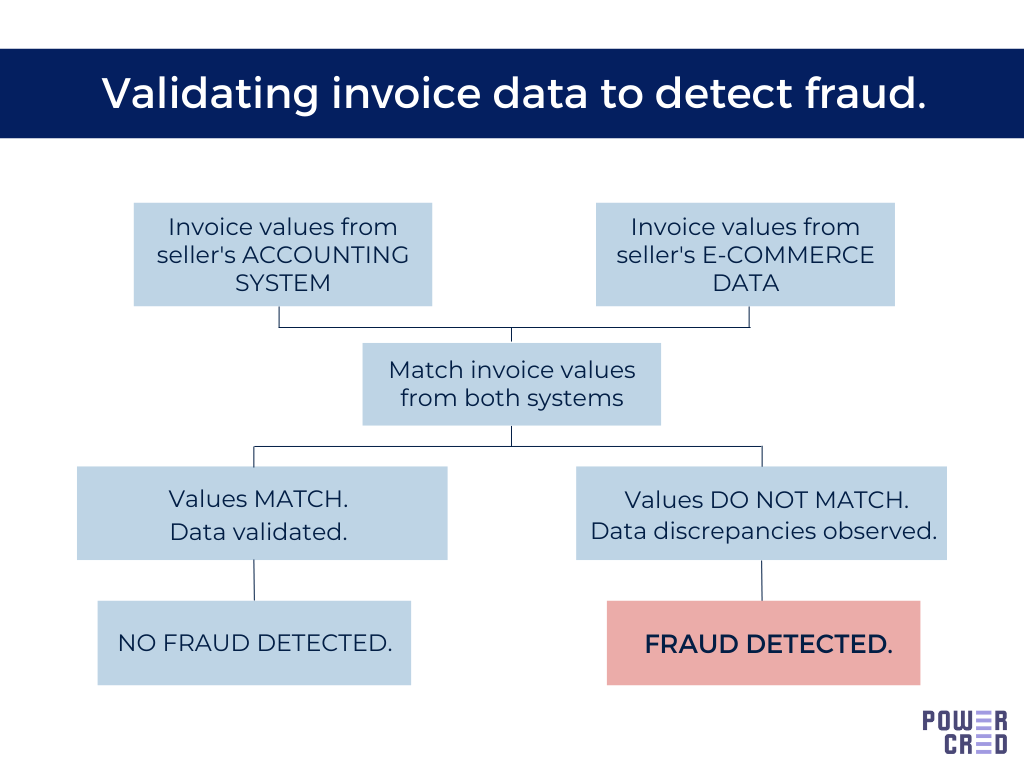

Similarly, at PowerCred we help our customers detect and prevent potential fraud by deploying alternate data and data intelligence. Our unified APIs for small business alternate data help financial institutions and service providers identify possible fraudulent discrepancies in the alternate data of their customers. Validation of alternate data can help detect frauds, for example, validating invoice data by matching the invoicing values from a seller’s accounting system data and e-commerce data can help identify discrepancies in the invoicing data of the seller.

Similar validation of identity data, purchase data, payout data, seller profile data and more of small businesses can help financial institutions identify areas of fraud and conduct further investigation into the relevant areas. Using alternate data for fraud detection and prevention helps financial institutions better understand the credibility of their small business customers, prevent associated losses and take timely and more informed business decisions.

Conclusion

The increase in online frauds and the risks and losses associated with such frauds has made it vital for businesses to step up and manage frauds more effectively. Research on the true cost of fraud in Indonesia suggests:

- For every fraudulent transaction, the loss incurred by businesses in Indonesia is actually 3.25 times the amount of the lost transaction value.

- This translates to fraud costs amounting to 1.66% of annual revenues overall.

Thus, early detection and prevention of fraud can help businesses save a tremendous amount of money in losses and operate more efficiently in this highly competitive and dynamic digital-first environment. With access to alternate data, seamless APIs and data intelligence, fraud detection and prevention are now more convenient and digitally advanced, helping businesses improve their decision-making, business efficiency and fraud management practices while minimising losses associated with frauds.

To know more about detecting and preventing fraud with alternate data, get in touch or simply book a demo with us.