The pandemic had pushed most small businesses into survival mode where they needed immediate financial support to stay afloat. During such challenging times, alternative financing offered tremendous support to small businesses by providing them with quick access to finance at competitive interest rates. The pandemic also gave a boost to the adoption of digital technologies by SMEs which brought them a step closer to being able to access financial services from non-traditional lenders and financial institutions. Due to a less-than-satisfying lending experience from traditional banks during the pandemic, about 67% of SMEs in Indonesia decided to take up new or alternative borrowing products in the year 2022. Competitive interest rates had now become the top decision driver when taking a loan for SMEs in the Asia Pacific.

The changing preference of SMEs in the APAC region due to their less than satisfactory lending experience with traditional banks presented an opportunity for lenders to fulfil the credit needs of small businesses by leveraging their alternative data. However, lenders needed to go a step further and make sure they offered not just the required financial services to the SMEs but also an enhanced lending experience. A convenient, quick and transparent lending experience was more important now than ever for the SMEs in the APAC region.

What did the SMEs expect?

For SMEs, mostly unbanked or underbanked by traditional banks, gaining access to the required amount of finance was now the most important factor when choosing a lender. A few other factors that SMEs gave weightage to while choosing a loan provider or lending institution included:

1. Competitive interest rates

2. Quick access to finance

3. Simplified process

4. Higher chances of approval

5. Customized products

How could financial institutions meet SME expectations and enhance their lending experience?

Financial institutions and service providers are able to serve their small business customers by leveraging their alternative data in the absence of sufficient traditional financial data. Lending with alternate data also offers extended benefits that can help lending institutions fulfil the expectations of their SME borrowers and enhance their overall lending experience.

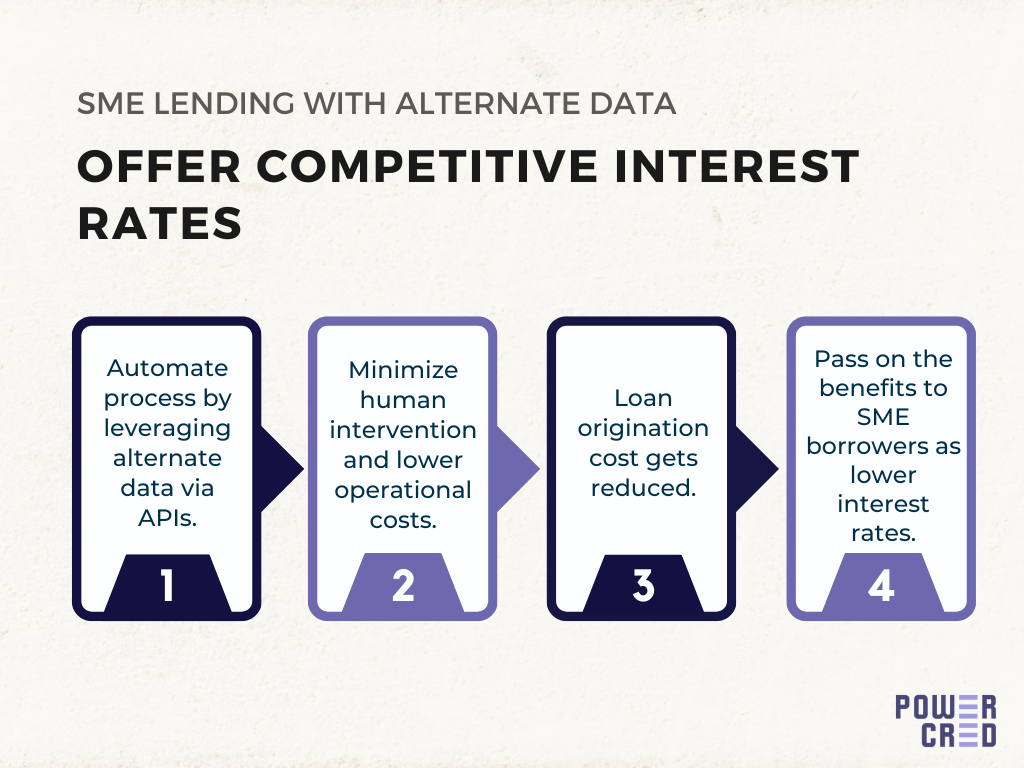

Competitive interest rates

Lending processes leveraging SME alternate data using APIs for a more automated approach could reduce the loan origination cost which could translate to lower interest rates for the borrowers. Also, alternative data give insights into the creditworthiness and repayment capacity of the small business that can help the lender to gain confidence to offer a more competitive interest rate to the borrower.

Quick access to finance

A few common problems that the SMEs faced while trying to take a loan from traditional banks was the lengthy process, the delay in access to finance and an insufficient amount of finance received. SMEs often need quick short-term loans to make sure they have enough cash flow to keep the business running. Alternate data and API-based lending processes are automated, quick, comprehensive and insightful that can enable lenders to make accurate yet quicker lending decisions and give faster access to finance to borrowers.

Simplified process

Most lenders allow SMEs to apply for a loan using their mobile phones and without actually physically visiting an offline branch. Lenders could integrate with alternate data APIs to create a seamless experience for SMEs where they can apply for a loan by simply selecting the platforms whose data they would like to share with the lenders for credit risk assessment. Simplification of the application process and minimization of the effort to be made by the applicant could significantly improve the loan application experience for the SME.

Higher chances of approval

Lenders leveraging the alternative data of SMEs use insights from multiple data sources to gain an overview of the financial health of the business. Insights from alternate data could help lenders assess the performance of the business, its creditworthiness, the credit risk involved and the repayment capacity of the SME. Such an overview can provide SME lenders with the confidence to offer loans to even the ‘thin file’ applicants, increasing the rate of loan approvals.

Customized products

SMEs can be very different in terms of their financial needs where one size might not fit them all. Analyzing the alternative data of the SMEs at a more granular level could help fintech lenders identify gaps that could be plugged in with customized products. Understanding and catering to the specific needs of SMEs could significantly enhance the customer experience and create a loyal customer base for lenders.

Conclusion

Given the highly competitive landscape where lenders are competing with traditional banks as well as with other lenders, an enhanced customer experience may be the key to creating stickiness and a loyal customer base. Lenders need to optimize their processes alongside consistently improving their product offerings to serve their SME customers better. Leveraging new sources of data and adding layers of intelligence to the data collected could help make smarter and quicker lending decisions. However, process automation and minimizing costs should also be a priority to survive in the highly competitive environment. Passing on benefits to the customers and proactively identifying and tailoring products to suit their dynamic needs is more crucial now than ever.

PowerCred helps lenders unlock the power of alternate data of small businesses to build better products for their customers. If you’d like to know more about how we do it, get in touch or simply book a demo with our team.